Last Updated on May 22, 2022 by Mary Pressler

Tax Credits for Roof Replacements: How To Qualify

Currently, the IRS does not offer a dedicated tax incentive for roof replacement projects. There used to be a 10% tax credit for metal and asphalt roofs compliant with ENERGY STAR, up to a maximum amount of $500, but the benefit ended in 2021. However, a new roof can still benefit indirectly from two other incentives:

Here we will discuss how each of these tax credits can be applied when installing a new roof or replacing an existing one. Tax credits reduce the net cost of energy upgrades, improving their return on investment and shortening their payback period. Depending on where your property is located, it may be possible to combine federal and local tax credits with energy rebate programs from utility companies.

Using the Solar Investment Tax Credit in a Roof Replacement

The ITC is normally used for solar panel systems, where the owner can deduct 26% of project costs from the next tax declaration. The solar federal tax credit will be decreased to 22% in 2023, unless there is another extension, and starting from 2024 there will be a 10% credit for businesses only.

The federal tax credit can be claimed when you install a new roof with solar panels, but only the costs associated with the photovoltaic system are considered for the deduction. However, if your new roof uses solar shingles or tiles to generate power, you can apply the tax credit directly. You cannot claim 26% of the entire roof replacement cost, but all the components associated with solar generation are eligible.

There are several solar roof providers in the market. Some of them give you the option of only upgrading part of your roof with solar shingles or tiles, while others will only quote complete roof replacements.

- Solar roof providers who offer partial upgrades and full replacements: Luma Solar, SunTegra, CertainTeed, SunPower.

- Solar roof providers who only offer full replacements: Tesla, GAF Energy, Forward Solar.

A solar roof can be a cost-effective option if you’re considering solar power and also need a roof replacement soon. You can combine two projects into a single installation, and the photovoltaic components of your roof will qualify for the 26% federal tax credit. Solar panels should not be installed on a roof that will need a replacement soon, or you will be forced to remove them during the upgrade. This is a complex procedure that will normally void manufacturer warranties.

The Commercial Buildings Energy Efficiency Tax Deduction

Commercial roof replacements can benefit from the energy efficiency tax credit, which offers a deduction of up to $1.88 per square foot. This is not a dedicated incentive for roof replacements, strictly speaking. However, a renovation project that includes a new roof can qualify if the building envelope performance is improved.

To get the $1.88/sq.ft. tax deduction, your building must achieve 50% energy savings with a combination of energy upgrades in four areas: indoor lighting, HVAC, hot water, and building envelope performance. Since the roof is part of your building envelope, upgrades that improve insulation and airtightness qualify for this benefit.

Achieving 50% energy savings is not always possible or cost-effective for building owners, but there is also a partial credit of up to $0.63/sq.ft. To qualify for the reduced tax credit, the building must achieve 10% building envelope savings, 15% HVAC and hot water savings, and 25% lighting savings.

If you’re a commercial building owner applying for this tax credit, there are two important requirements:

- The savings must be calculated with respect to the minimum performance level established in ASHRAE Standard 90.1, not your current energy consumption.

- The savings must be validated with energy modeling software approved by the US Department of Energy and IRS.

The same building can qualify for the solar tax credit and energy efficiency tax credit, but the savings achieved by solar power don’t count towards the 50% requirement of the energy efficiency tax credit.

Share this entry

https://quickelectricity.com/wp-content/uploads/2024/10/Does-Temperature-Affect-Your-Electricity-Bill.jpeg

1024

1024

Kelli

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Kelli2024-10-18 06:06:002024-10-18 06:07:12Does Temperature Affect Your Electricity Bill?

https://quickelectricity.com/wp-content/uploads/2024/10/Does-Temperature-Affect-Your-Electricity-Bill.jpeg

1024

1024

Kelli

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Kelli2024-10-18 06:06:002024-10-18 06:07:12Does Temperature Affect Your Electricity Bill? https://quickelectricity.com/wp-content/uploads/2024/09/What-Appliances-Use-the-Most-Energy.jpg

512

768

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Mary Pressler2024-09-16 07:54:382024-09-16 07:54:38What Appliances Use the Most Energy?

https://quickelectricity.com/wp-content/uploads/2024/09/What-Appliances-Use-the-Most-Energy.jpg

512

768

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Mary Pressler2024-09-16 07:54:382024-09-16 07:54:38What Appliances Use the Most Energy? https://quickelectricity.com/wp-content/uploads/2024/09/Recommended-Thermostat-Settings-for-Summer.jpg

425

800

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Mary Pressler2024-09-04 00:11:502024-09-10 00:13:22Recommended Thermostat Settings for Summer

https://quickelectricity.com/wp-content/uploads/2024/09/Recommended-Thermostat-Settings-for-Summer.jpg

425

800

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Mary Pressler2024-09-04 00:11:502024-09-10 00:13:22Recommended Thermostat Settings for Summer https://quickelectricity.com/wp-content/uploads/2024/08/The-Ultimate-Power-Outage-Kit-List-for-2024.webp

683

1024

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Mary Pressler2024-08-27 02:47:392024-08-27 08:12:59The Ultimate Power Outage Kit List for 2024

https://quickelectricity.com/wp-content/uploads/2024/08/The-Ultimate-Power-Outage-Kit-List-for-2024.webp

683

1024

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Mary Pressler2024-08-27 02:47:392024-08-27 08:12:59The Ultimate Power Outage Kit List for 2024 https://quickelectricity.com/wp-content/uploads/2024/07/6-Electrical-Safety-Rules-for-Your-Rental-Property-1.png

3648

5472

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Mary Pressler2024-07-30 16:15:192024-07-30 16:15:19Electrical Safety For Rental Properties

https://quickelectricity.com/wp-content/uploads/2024/07/6-Electrical-Safety-Rules-for-Your-Rental-Property-1.png

3648

5472

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Mary Pressler2024-07-30 16:15:192024-07-30 16:15:19Electrical Safety For Rental Properties https://quickelectricity.com/wp-content/uploads/2024/07/Lubbock-Electricity-Bill-Explained-scaled.jpg

1360

2048

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Mary Pressler2024-07-21 08:55:502024-07-23 20:14:08Your Lubbock Electricity Bill Explained

https://quickelectricity.com/wp-content/uploads/2024/07/Lubbock-Electricity-Bill-Explained-scaled.jpg

1360

2048

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Mary Pressler2024-07-21 08:55:502024-07-23 20:14:08Your Lubbock Electricity Bill Explained https://quickelectricity.com/wp-content/uploads/2024/06/Risk-of-Energy-Emergency-Alert-with-Low-Wind-Conditions-ERCOT-Grid-Summer-2024.png

371

600

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

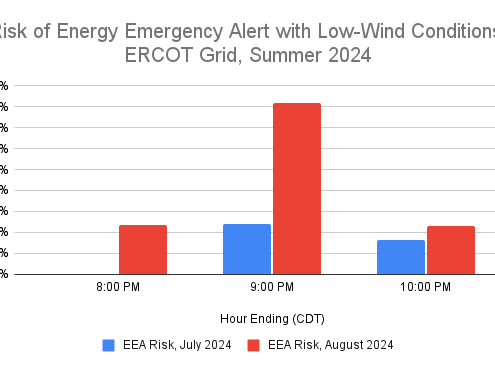

Mary Pressler2024-06-26 09:47:422024-06-26 09:47:42Texas Electricity Outlook Summer 2024

https://quickelectricity.com/wp-content/uploads/2024/06/Risk-of-Energy-Emergency-Alert-with-Low-Wind-Conditions-ERCOT-Grid-Summer-2024.png

371

600

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Mary Pressler2024-06-26 09:47:422024-06-26 09:47:42Texas Electricity Outlook Summer 2024 https://quickelectricity.com/wp-content/uploads/2022/08/Texas-Electricity-Broker-.png

1080

1080

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Mary Pressler2024-06-18 16:14:522024-06-22 08:43:08Commercial Energy Broker in Texas

https://quickelectricity.com/wp-content/uploads/2022/08/Texas-Electricity-Broker-.png

1080

1080

Mary Pressler

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Mary Pressler2024-06-18 16:14:522024-06-22 08:43:08Commercial Energy Broker in Texas https://quickelectricity.com/wp-content/uploads/2024/05/Electricity-Options-Texas.jpg

627

1200

Kelli

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Kelli2024-05-14 04:05:352024-05-14 04:05:35Demystifying Energy Contracts: What Texans Need to Know

https://quickelectricity.com/wp-content/uploads/2024/05/Electricity-Options-Texas.jpg

627

1200

Kelli

https://quickelectricity.com/wp-content/uploads/2021/10/Quick-Electricity-Logo--300x79.jpg

Kelli2024-05-14 04:05:352024-05-14 04:05:35Demystifying Energy Contracts: What Texans Need to Know